Indicators on Forex Trading You Should Know

Wiki Article

7 Simple Techniques For Forex Trading Apk

Table of Contents6 Simple Techniques For Forex Trading LegitAn Unbiased View of Forex Trading StrategiesForex Trading Apk for DummiesSome Known Details About Orex Trading For Beginners Things about Orex Trading For Beginners

The top part of a candle light is used for the opening rate and greatest rate factor used by a money, as well as the lower part of a candle light is utilized to show the closing price and most affordable rate point. A down candle light represents a duration of decreasing rates and also is shaded red or black, while an up candle is a duration of raising prices and also is shaded green or white.Extreme amounts of utilize have brought about several dealers becoming financially troubled suddenly. Financial institutions, brokers, and also dealerships in the forex markets enable a high quantity of take advantage of, which implies that investors can manage huge positions with fairly little cash of their own. Leverage in the series of 100:1 is not unusual in forex.

The 8-Minute Rule for Trading Forex Vs Crypto

Such currencies typically belong to developing countries. The very first action to foreign exchange trading is to educate on your own regarding the market's procedures and also terms.

Forex Trading Legit Fundamentals Explained

Today, it is simpler than ever to open and also money a foreign exchange account online and begin trading currencies. For those with longer-term perspectives and bigger funds, long-term fundamentals-based trading or a carry trade can be successful.Foreign exchange trading is a means of spending which includes trading one money for one more. The main aim of foreign exchange trading is to effectively predict if the value of one currency will boost or lower contrasted to the various other. A trader might get a money today, believing its worth will certainly go up tomorrow as well as plan to market it for an earnings after that.

That's because whenever you get one money, you concurrently market the various other one. Each currency pair is comprised of 2 parts: the initial currency noted in the quote and also constantly equal to 1 the second currency noted in the quote As an example, let's take a look at this currency pair: Right here, the base currency is GBP (pound sterling) and the quote currency is EUR (euros).

Unknown Facts About Trading Forex Vs Crypto

These can be a little complicated to get your head click for source around at. It aids to keep in mind that prices are always detailed from the foreign exchange broker's point of view rather than your very own. In the eyes of a broker, potential purchasers need to place a bid when you sell a money.In foreign exchange trading, the distinction between the acquiring rate and market price of a money pair is called the spread. It's also understood as the 'buy-sell spread' or 'bid-ask spread'. You can exercise the spread of a currency set by checking out a forex quote, which reveals the proposal and also ask costs.

Whereas a low spread suggests that there is a small distinction between the bid and ask rate. The find out here now spread is gauged in pips, which is the tiniest quantity a currency price can transform. Leverage functions a little bit like a car loan and allows you borrow cash from a broker to ensure that you can trade bigger quantities of currency.

Examine This Report about Trading Forex Vs Crypto

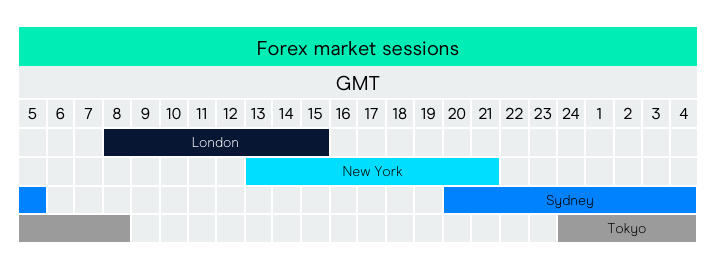

This is since contrasted to common trading, the dangers are magnified and you can stand to lose more than simply your preliminary deposit, which could be money you can't afford. There are a few advantages and disadvantages to take into consideration before getting started with foreign exchange trading.: forex trading is a massive worldwide market which suggests that there are great deals of opportunities to trade.you do not require a great deal of money to obtain started with foreign exchange trading as well as can make use of leverage to improve your investment opportunity. foreign exchange trading runs for 24 hr from Sunday to Friday, unlike various other markets which have actually trading forex vs stocks limited trading hours during the week. the worth of currencies varies frequently as well as can be very uncertain.

adjustments in the exchange rate might suggest that your profit is impacted when it's transformed back into the money you take your profits in. some countries have trading limitations on how much money can be traded at a specific rate during different times. In the past, a forex broker would trade currencies on your behalf.

Report this wiki page